State of Initiative: Mixed signals on AI in investment plans, production systems, survey shows

What you'll learn:

- The single biggest challenge to realizing digital transformation: talent and human resources and securing funding.

- Almost 46% of respondents, when asked to characterize those transformation efforts within their organizations, called them “problematic but ongoing.”

- However, almost 60% agreed that transformation will have a high impact on their organizations.

- Nearly 75% of respondents saw "drastic" challenges with their incoming supply chains (the kind most effected by tariffs).

Editor’s note: For the first time this year, the results of our annual State of Initiative survey appear here as a web feature. The downloadable PDF version of the report has been discontinued.

Even as manufacturing looks into a new year and AI has begun to penetrate production systems and investment plans, significant challenges—such as a shrinking and underskilled labor force and underinvestment and a lack of commitment and understanding by corporate leadership—held digital transformation back in many organizations in 2025, Smart Industry’s weekslong fall and winter State of Initiative survey revealed.

A fair amount of pessimism comes through in the results of the survey, conducted via email from October through mid-December 2025 to Smart Industry subscribers.

At this time last year, the survey reflected more optimism with some caution tempered by unknowns heading into 2025.

Much turbulence—like an economy that continues to stagnate with higher inflation and prices and U.S. government instability brought on by Donald Trump’s takeover and his tariff regime—continues today, and this seems to come across in survey results at the dawn of 2026.

Crystal Ball 2026: AI dominates manufacturing technology and other predictions from our exclusive series

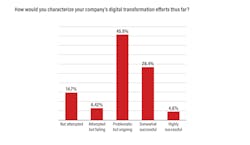

The clearest indication going into this year, at least when it comes to digital transformation? Almost 46% of respondents in the fall, when asked to characterize those efforts within their organizations, called them “problematic but ongoing.”

However, almost 60% (59.6%) believed digital tranformation to be vital and agreed that transformation will have a high impact on their organizations. And a third (33.33% exactly) reported they’d identified applications and are making investments when asked about their progress on transformation.

Only about 29% of respondents said such efforts at their companies had been “somewhat successful” while just 4.6% characterized them in the most optimistic language as "highly successful." So there is forward motion on digital transformation.

Tariffs, disrupted supply chains also play prominently

One question on the survey, about Trump’s tariffs, drew interesting and indicative results of the impact the import levies are having on supply chains, though some of the results appear somewhat contradictory.

Almost 75% of respondents in Smart Industry’s survey saw drastic challenges with their incoming supply chains (the kind most effected by tariffs) while 54% responded that they saw at least "some" challenges with their incoming supply chains.

See also: How can manufacturing survive and thrive in the tariff era

Last year, 69% of respondents reported drastic challenges while an almost identical number to this year, 55.79%, reported some challenges. Interestingly, this year 62% reported no changes or challenges to their incoming supply chains, while 51% said the same thing last year.

At the same time, almost 26% saw drastic challenges with their outgoing supply chains (the number last year was 31%) but almost 50% in the latest State of Initiative survey saw "some" level of chaos with their outgoing supply chains whereas 44% said the same thing last year.

The survey definitively shows awareness about supply chains is high, though that also could be leftovers from the pandemic.

Signals still mixed about AI adoption

Despite a more gung-ho attitude in a lot of quarters of manufacturing technology—including contributors to Smart Industry’s just concluded Crystal Ball 2026 Series—enthusiasm for artificial intelligence adoption among our State of Initiative survey respondents was split between those who said their organizations had no plans to use AI in critical systems (about 47%) with those who are early adopters (about 46%) of the hyped technology. Power users (3.7%) and those “all-in” on AI (2.7%), as they did last year, represented very small slices of the survey respondents.

Crystal Ball 2026: The year AI moves from promise to production

Last year, a slightly higher percentage (50%) saw their companies as “early adopters” of AI and machine learning while nearly half hadn’t embraced AI and ML in their existing systems or didn’t intend to at all—so enthusiasm for AI in Smart Industry’s survey almost appears mixed or flat.

Details did emerge from the State of Initiative survey about where respondents saw AI benefiting their operations the most, ranked in a top-5 order.

For example, higher percentages of the respondents, 25% or more, saw supply chain management, automation, quality, sales and corporate management, and cybersecurity as their top uses for AI or AI-enhanced systems. Design (22%) and sustainability (20%) weren’t far behind.

Other technologies gain traction in digital transformation

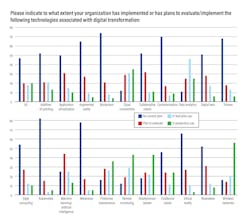

Aside from AI, the survey has some points about the penetration of other tech commonly associated with digital transformation:

- Cloud connectivity (33%), data analytics (23%), and traditional robotics (23%) were the technologies that had penetrated the most into “production use.”

- Collaborative robots, or cobots, have reached production-use penetration among 10.5% of respondents.

- Momentum for many technologies that have moved more to production use compared to last year include: wireless networks (53%); remote monitoring (42%); smartphones/tablets (40%); predictive maintenance (34%), which is a manufacturing technology that has come to be closely associated with AI (34%); and 5G (20%).

- Other tech seems to have lost momentum (below 10% in production use) compared to our last State of Initiative survey: edge computing (9.7%); application virtualization (9.4%); containerization (8.7%); wearables (7.8%); and kubernates and metaverse (both 4.8%).

Getting granular on digital transformation

There were still more details about transformation that popped up as notable from our survey:

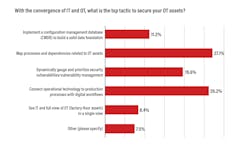

- Their single biggest challenge to realizing digital transformation: talent and human resources (38.5%) and securing funding (27.5%).

- Cost reductions, increased productivity, and enhanced customer satisfaction all rank the highest, or very important, from about 39% to 43%, when respondents were asked how important to their business interests is digital transformation.

- The most significant challenges to digital transformation: the workforce skills gap (45%); lack of an employee knowledge base (43%); lack of a senior management knowledge base (35%); lack of understanding of transformation’s impact to their businesses (33%); and security concerns (also 33%).

If we were to read the mood of manufacturers and their appetites for digital transformation, the picture looks a lot like views of the American economy (and politics) in other surveys: sharp division mixed with hesitation and pessimism. And contradictory.

Snapshot of the survey respondents

Of the respondents to Smart Industry’s State of Initiative survey, more than a quarter—27%—did not specify which industry they represented, so it was difficult to gleen which corner of manufacturing had the most prominent voices in our poll going into the new year.

However, 21% did say they repped a discrete manufacturer or industrial machine builder while equal percentages—17%—said they either worked for a process manufacturer or worked in engineering or professional services.

Much smaller percentages said they represented transportation or logistics (10%), power generation (3.7%), and oil/gas or mining (1.8% each).

The respondents’ primary job functions varied, of course, but fell along predictable lines:

- General and corporate management (22%)

- Project management and execution (15.7%)

- Maintenance and reliability (14%)

A smattering of respondents work in other functions: environmental health and safety (9.3%); IT and networks (5.6%); production planning, sales/marketing and logistics/supply chain (all 7.4%); and quality assurance (6.5%).

Please look for invitations in your inboxes, our newsletters and on this website later this year to participate in the next State of Initiative survey, the results from which will come out around this time in 2027.

But you can't participate and have your voice heard if you aren't a Smart Industry member, so please sign up!

About the Author

Scott Achelpohl

Head of Content

I've come to Smart Industry after stints in business-to-business journalism covering U.S. trucking and transportation for FleetOwner, a sister website and magazine of SI’s at Endeavor Business Media, and branches of the U.S. military for Navy League of the United States. I'm a graduate of the University of Kansas and the William Allen White School of Journalism with many years of media experience inside and outside B2B journalism. I'm a wordsmith by nature, and I edit Smart Industry and report and write all kinds of news and interactive media on the digital transformation of manufacturing.