We’re all familiar with TCO, or the total cost of ownership. Rather than just considering the cost of equipment and software, end-users consider the energy, maintenance, bandwidth costs and other costs related to new technologies. This concept developed as a way to get buyers past the sticker shock of new equipment by reminding them that their new laptop or server rack was really just a minor part of the equation. So quit haggling over nickels. (In fact, TCO has become so pervasive, a new metric, called TCA, or total cost of acquisition, has been gaining popularity to focus people on the cost of the equipment again.)

But there’s a big problem with total cost of ownership. When you think about it, TCO focuses on the negative. It doesn’t tell you what you can earn from investing in technology, just what you’ve sunk into it. The best TCO is, ultimately, zero.

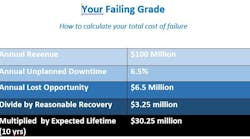

Hence, I’d like to introduce a new concept: TCF, or total cost of failure. This is the amount of revenue or net income you’re losing if you don’t make an investment. Or, conversely, TCF is the amount of money you can recover if you make the right investment.

What goes into TCF? First, multiply gross sales (or net income) by the amount of unplanned downtime in a facility. If a particular facility produced $100 million worth of product but experienced 6.5% unplanned downtime, that gives you $6.5 million.

Now…divide that figure by two. You can’t prevent all failure, but reducing it by 50% can be considered a realistic goal. We’re down to $3.25 million (If you’ve got better data about theIf you want to go further, divide the TCF--$30.5 million--by annual revenue to determine how large failure looms in total revenue. This is handy because now small organizations can be compared directly against larger ones. It theoretically also lets you compare plant-to-plant performance.

Granted, the above numbers are fictional. I also live in abject squalor compared to most captains of industry, so take any financial recommendations from me with a grain of salt. But it’s a start and a handy way of thinking about a new investment. You could also add in factors like spent energy and productivity, and include your own data, to go beyond the thumbnail.

Either way, there’s no denying that unplanned downtime remains a major, chronic problem. Process industries lose $20 billion a year due to unplanned downtime and 80% could be prevented.

It’s also a problem outside the industrial world. IDC estimates that unplanned application downtime costs companies $1.25 to $2.25 billion per year. More fun facts: Enterprise Strategy Group (in a survey sponsored by Stratus Technologies) of 250 IT decision makers found that the average downtime event lasted 87 minutes, although 72% of applications are designed to recover after 60 minutes and 53% are supposed to be humming along after 15 minutes. A minute of downtime in the auto industry runs around $22,000. Clearly, something’s not adding up.

And if you have feedback or tweaks on the idea, shoot me a note or comment below.