By the numbers: The impact of COVID-19 on manufacturing

By Lou Zhang, MachineMetrics chief data scientist

The COVID-19 pandemic is causing everyone to feel a bit uncertain. Our day-to-day lives are being impacted and so are our businesses. More than ever, employees are looking to their management teams for direction to lead them through this difficult time. Thoughtful management of your people and resources, and using data to make good decisions is critical. There will be a lot to balance in the coming weeks...customer needs, supply chain challenges, staffing considerations, etc. But having a strategy to leverage data to aid in decision-making is key.

Leveraging our larger data set, we are closely monitoring the impact COVID-19 is having on manufacturing and providing updates regularly. Our data-science team has been focusing their efforts on reporting the impact of coronavirus on the manufacturing industry to be able to provide accurate data and guidance to business owners, economists, and the public right now on manufacturing.

The methodology:

MachineMetrics streams data live off of thousands of machines across the United States, covering all geographies, sizes of companies, and major industries. We have collected data from more than 1 billion parts, and have a representative sample of US manufacturing. We regularly lead indicators like capacity utilization and industrial production. We believe our data can be especially helpful in times like these, when monthly economic indicators may be slow to come out or inaccurate due to under-reporting from sampled companies.

The early April trends

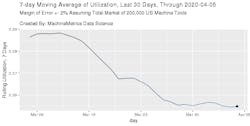

Since late March there have been several notable trends. Most importantly, the decline in utilization seems to have leveled off, for now, due largely to manufacturers re-tooling and responding to demand for necessary life-support equipment.

We saw a relative 17% decline, or ~5% absolute decline, in utilization during the month of March, from ~30% to ~25%. It appears as if a stabilization has occurred starting on March 28. This is the day the US surpassed China as having the most coronavirus cases in the world, the House approved a $2 trillion dollar stimulus package, and hospitals really heightened their alarm for ventilators and PPE. These elements may have driven some manufacturers to choose to re-tool rather than shut down in the days leading up to the 28th.

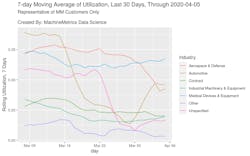

Digging deeper into this by industry, we validate the data corroborates our theory amongst our customer base. There was a marked increase in utilization from the automotive and industrial-machinery segments around the end of March, as they prepare to re-tool to manufacture medical components. This has partially offset the continued decrease we see in aerospace & defense, as Boeing and other major manufacturers continue to struggle. Medical-device manufacturing, unsurprisingly, continues to rise and is now our highest-utilization industry as of March 3, historically being in third place.

Note that industry breakdowns do not have large enough sample size per vertical to claim that this reflects broader industry trends. We merely claim these trends hold true for MachineMetrics customers.

The future?

In any time of economic uncertainty, there is an even greater need to be well-informed, in order to make smart business decisions for the good of your organization. We’ll be making regular updates via our blog with the goal of providing as much insight as we can to our customers and the manufacturing community as a whole. Until then, stay tuned and stay safe.