Despite plans to invest in machines and artificial intelligence (AI) as part of strategies to boost productivity, many automotive and industrial-equipment companies are failing to implement the measures needed to harness these capabilities, according to a new report from Accenture.

The report, “Machine Dreams: Making the Most of the Connected Industrial Workforce,” is based on interviews with more than 500 business executives in Asia, Europe and the United States involved in setting their company’s strategy for the connected industrial workforce. According to the report, manufacturing and production are undergoing rapid change as machines and artificial intelligence become integrated with personnel, creating the connected industrial workforce. By combining mobile, safety and tracking technologies with analytics, companies are enhancing the activities of an industrial worker.

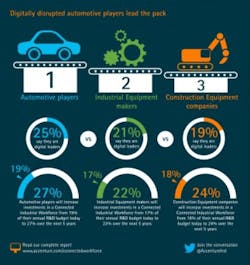

The report concludes that the creation of a connected industrial workforce is already part of the business strategy of the majority of automotive and industrial-equipment producers. Respondents estimate that their companies could direct one-quarter of their R&D expenditure over the next five years to connected industrial-workforce technologies.

But while the manufacturing companies surveyed believe that the impact of the connected industrial workforce will be significant, the research reveals that the companies making these investments could fail to maximize the competitive advantage that the investments can bring. 22 percent of respondents said their companies have implemented measures designed to realize the potential of a connected industrial workforce, with 85 percent of respondents describing their companies as digital followers or laggards, rather than leaders.

One issues that could slow the implementation of a connected industrial workforce is the related technology. Data-vulnerability is seen as a medium or high risk for 76 percent of respondents, while system-complexity and related vulnerability is seen as medium or high risk by 72 percent of respondents. In addition, more than two thirds of respondents consider a shortage of skilled human workers to be a high or medium risk. This could also impact companies’ ability to deliver on their connected industrial-workforce strategy

“Those leading manufacturers investing in digital technologies to harness competitive advantage are spending almost twice as much as laggards on the connected industrial workforce—and will continue to raise the bar over the next five years,” said Eric Schaeffer, senior managing director and head of Accenture’s Industrial practice. “We also see laggards lacking the confidence to implement the technologies that underpin a successful connected industrial workforce and this may threaten their competitiveness.”

The vast majority of respondents said they expect the focus of technology in manufacturing to evolve from human to human/machine-centric, where collaborative machines, machines augmented by humans, and autonomous machines are combined to create a more effective workforce.

A number of the organizations surveyed have a clear focus for investments relating to workforce effectiveness. Autonomous guided vehicles—mobile robots that move materials around a facility—already account for half of spending by these companies in this area. The same organizations plan to boost their investments in both collaborative robots (“cobots”) and augmented-reality devices, including smart glasses and helmets, over the next five years.

In their efforts to tackle security concerns, a number of respondents are also investing heavily in upgrading their existing IT infrastructures to ensure a securely connected workforce. Among the respondents who believe they are leading the creation of the connected industrial worker, 89 percent have hired new talent to close the skills gap.

Driving the trend

Among the respondents who are seeking to use technology to improve productivity, automotive manufacturers and suppliers have the highest interest in collaborative robots, automated guided vehicles and augmented-reality devices.

“As cobots take on more and more specialized tasks, leading manufacturers that are investing in digital to harness competitive advantage are moving rapidly toward human/machine-centric manufacturing,” said Schaeffer.

The report also identified some differences by country in terms of their R&D investments in connected workforce technologies. US respondents expect to make the highest percentage of R&D investment in the connected industrial workforce, at 40 percent of total R&D spend. The next highest percentage is for respondents in China, estimating 23 percent of R&D to be spent in this area, falling to 17 percent of total R&D spend for respondents in Japan. The respondents in Germany and France estimate 20 percent and 19 percent respectively.