Digitizing horizontal and vertical value chains

Smart Industry: What most surprised you in the responses?

Bobby: It was surprising that 35% of survey participants believe they have achieved a high level of digitization today. Likely that response is based on their current view of digitization versus the realm of possible digitization. In other words, if we laid out some of the cutting-edge uses of Industry 4.0—ones that are on the edge of possible today and will be possible in the near future—this number would probably be much lower.

Smart Industry: Any major differences between U.S. and non-U.S. respondents?

Bobby: We found that companies in Japan and Germany are the furthest along in digitizing internal operations and partnering across the horizontal value chain. With high investment in technology and employee training, they view their digital transformation primarily in terms of gains in operational efficiency, cost-reduction and quality assurance. China’s industrial companies stand out in all aspects of digitization; they are expecting both above-average cost reductions as well as increased digital revenues through to 2020. China is one of the countries that stands to gain the most from automating and digitizing labor-intensive manufacturing processes and needs to find a solution to rising employee costs. In addition, Chinese companies are highly flexible and open to digital change.

Smart Industry: According to your survey, industrial-manufacturing companies plan to invest 5% of annual revenue in digital operations solutions over the next five years. What does that indicate to you?

Bobby: The investment is an indication that Industry 4.0 isn't a buzz word or a fad that will pass. We're embarking upon the fourth industrial revolution and companies realize that there are big rewards for those who capitalize on this change.

Bobby: Companies waiting for the ‘perfect’ technology or 'perfect' timing are being shortsighted. The biggest challenge that companies face isn’t buying the right technology, it is transforming their people and culture, which require long-term change programs.

Smart Industry: Why is changing the culture of an enterprise such an important initiative?

Bobby: Changing the culture is necessary because Industry 4.0 has significant implications for the way in which a company chooses to organize itself and its delivery model. In other words, if we all appreciate that Industry 4.0 is an industrial revolution, the magnitude of the change becomes more apparent. Culture change is hard. It is even harder when the rules of 'the possible' are changing. Leaders will be working to change the culture of their organization while the rules of the game are evolving around them.

Smart Industry: Address a term used in your report--"digital trust."

Bobby: The term 'digital trust' is applicable to data analytics. The rapidly growing number of sensors, embedded systems and connected devices, as well as the increasing horizontal and vertical networking of value chains, results in a continuous data flow. Data is coming from multiple sources, in different formats, and there is a need to combine internal data with data from outside sources. Data analytics is essential to using data to create value. However, there is risk in using this data to make decisions without a rigorous, proactive approach to data security. It is critical that the data being used in the data analytics is reliable to the level of precision necessary for the purpose of an analytic. The reliability of that data will either build or deteriorate digital trust. Imagine a CEO, CFO or board of directors making an important decision with data that was later found to be incomplete or inaccurate. That type of set-back would definitely alter that organization's Industry 4.0 journey.

Digital trust is built using a set of internal controls and testing to validate that the data and the analytics are reliable. It is best if the controls and testing are built into the process of creating a data-analytics platform, versus adding the controls or doing the testing once the data analytics are being used.Smart Industry: What does the survey tell us are the greatest challenges around data analytics?

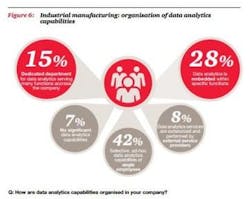

Bobby: A key challenge is skills. It’s an issue for all companies but is felt even more acutely by those in industrial manufacturing. Around half (51%) pinpoint lack of data-analytics skills in their own workforce as a particular data-analytics challenge. And nearly three quarters (73%) cite increasing in-house data-analytics technology and skill levels as the single biggest improvement route to boost their data-analytics capabilities. Another key challenge is the expense related to developing the skills and technology for meaningful data-analytics platforms.

Download the report here.